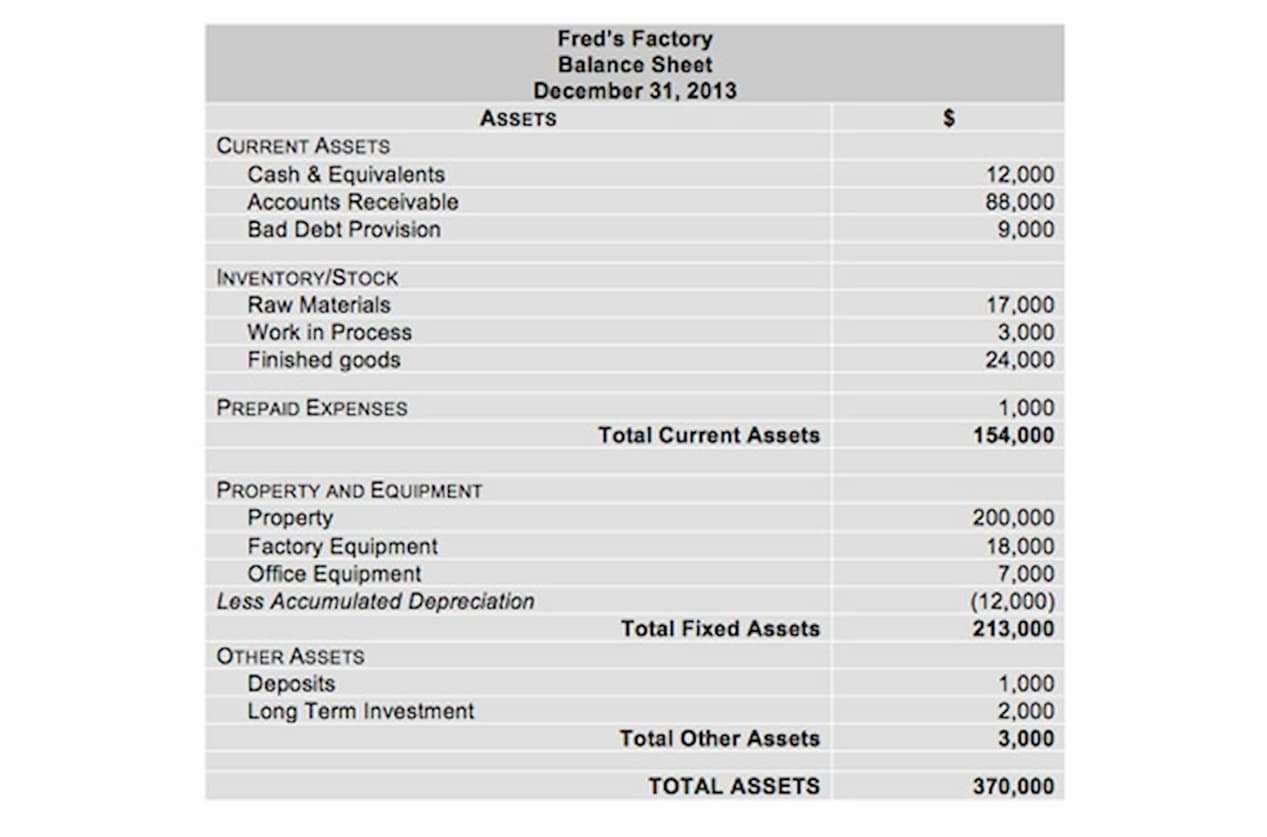

Plant assets are a group of assets used in an industrial process, such as https://www.bookstime.com/ a foundry, factory, or workshop. These assets are classified as fixed assets if their cost exceeds the capitalization threshold of a business, and they are expected to be used for more than one reporting period. Any asset may be included in the plant assets classification, as long as it contributes to the generation of sales. Plant assets and the related accumulated depreciation are reported on a company’s balance sheet in the noncurrent asset section entitled property, plant and equipment.

Introduction to Plant Assets

Equipment, machinery, buildings, and vehicles, are commonly described as property, plant, and equipment (PP&E). These items labeled are tangible, fixed, and not easy to liquidate. PP&E is listed on a company’s balance sheet minus accumulated depreciation.

- The Ascent, a Motley Fool service, does not cover all offers on the market.

- It can serve a commercial purpose and be seen as a factor of production.

- Noncurrent assets include intangible assets, such as patents and copyrights.

- Investors prefer to see more long-term and fixed assets on a company’s balance sheet, including land.

- Plant assets are a group of assets used in an industrial process, such as a foundry, factory, or workshop.

- The assets can be further categorized as tangible, intangible, current, and non-current assets.

IAS 16 Property, Plant and Equipment

IAS 16 Property, Plant and Equipment requires impairment testing and, if necessary, recognition for property, plant, and equipment. An item of property, plant, or equipment shall not be carried at more than recoverable amount. Recoverable amount is the higher of an asset’s fair value less costs to sell and its value in use. The objective of IAS 16 is to prescribe the accounting treatment for property, plant, and equipment.

- In business, assets can take several forms — equipment, patents, investments, and even cash itself.

- One also owns the area below and the airspace above its boundaries.

- Left by themselves, PP&E just sit there, but put into action by people with energy and purpose, they become a money-making machine.

- Land cannot be depreciated, meaning you cannot account for its cost by gradually reducing its value over its useful life span.

- In economics, land is considered a factor of production similar to labor as one of the crucial elements in creating goods and services.

Some final thoughts on plant assets

- Regardless of the company you’re analyzing, plant assets tend to be those held for long-term use and depreciated over their useful lives.

- A balance sheet is one of the three major financial statements that a small business will prepare to report on its financial position.

- The company would now adjust the carrying amount to £90,000, and depreciation would be calculated using the revalued amount.

- Fixed assets represent a more stable asset base and indicate a company’s long-term value.

- In the balance sheet of the business entity, these assets are recorded under the head of non-current assets as Plant, property, and equipment.

The PP&E account is remeasured every reporting period, and, after accounting for historical cost and depreciation, is defined as book value. To calculate PP&E, add the gross property, plant, and equipment, listed on the balance sheet, to capital expenditures. Companies commonly list their net PP&E on their balance sheet when reporting financial results. The name plant assets comes from the industrial revolution era where factories and plants were one of the most common businesses.

Therefore, we may consider land as a resource with no cost of production. In traditional economics, land is a factor of production, along with capital and labor. The land value may also be of interest to investors as it is land a plant asset can appreciate over time and generate profits for the company. Depreciation should be charged to profit or loss, unless it is included in the carrying amount of another asset IAS 16.48.

Commercial Real Estate

Factories, warehouses, and buildings that will facilitate business can be built on land. In addition, land cannot https://www.instagram.com/bookstime_inc easily be tampered with, in that there is nothing to steal from it (for the most part). It can be polluted and/or destroyed, but that can be prevented to a degree. Development can be for commercial or residential use and is subject to the aforementioned zoning ordinances and local regulations.

Objective of IAS 16

The term “land” encompasses all physical elements bestowed by nature on a specific area or piece of property—the environment, fields, forests, minerals, climate, animals, and bodies or sources of water. Land ownership might offer the titleholder the right to any natural resources that exist within the boundaries of their land. Purchasing land can be a capital investment for a business and signals the long-term intention of the small business when it comes to the “going concern” principle. Purchasing land initially for a startup or a small business may not be feasible, but for a large business, it is beneficial. Land built or designated for business uses, such as office buildings, retail establishments, and industrial facilities, is commercial real estate.

Why Should Investors Pay Attention to PP&E?

The matching principle states that expenses should be recorded in the same financial year when the revenue was generated against them. As the fixed assets last longer, the expenses are divided over the item until they’re useful. Land, as a fixed asset, is classified as a long-term, tangible asset. Land is a long-term asset, not a current asset, because it’s expected to be used by the business for more than one year.