Continued Support and MonitoringVirtual CPAs offer ongoing support and review to consistently ensure the client’s financial well-being. They regularly monitor and review the client’s financial data, identifying any discrepancies or areas that require attention. They proactively address potential issues, provide recommendations for improvement, and offer guidance on optimizing financial processes and controls. In addition to its real-time dashboard, which offers self-support features, clients can tap into indinero’s support team via phone, email, or live chat.

- Our experienced CFOs can provide the strategic financial leadership you need at a fraction of the cost of a full-time hire.

- If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you.

- While they do take care of your accounting, you will not be bombarded with numbers.

- It is important to note that both traditional accounting firms and virtual CPA firms have their own strengths and considerations.

- With Bookkeeper360, you’ll get a dedicated virtual accountant who sends detailed reports on a monthly basis.

Zweig was focused on tax and Davis on technology, so the two meshed well, especially since neither of them wanted to work from a brick-and-mortar office. You may need only account reconciliation services now but will need to layer on financial and cash flow management services later. If a firm only offers a package that includes services you don’t need, you may pay more than you should at this stage in your business. In addition, Pilot performs automatic transaction imports, monthly account reconciliations, and cash forecasting. Inventory tracking, accounts payable and receivable reporting, as well as tax preparation and filing, are add-on options for an additional fee.

So first you need to identify the kind of solution that your business needs and then pick a solution that best fits it. This can save you a great deal of money and also save you from penalties due to improper filing. There are no standard plans mentioned on their site but they do have an option to request a what is a purchase order definition and meaning quote where depending on your requirements, and the industry your business belongs to you can get a custom plan. If you are a small business with under a hundred transactions, the Basic plan might be ideal.

How to Set up Your Virtual Accounting Firm

It also will look for candidates who are conversant in your software, such as QuickBooks, Xero, Netsuite, and many other programs. Also, 1-800Accountant offers every business a free tax savings consultation with an expert. Better yet, 1-800Accountant guarantees its customers maximum tax savings by finding every deduction.

Provide Tools and Support for Your Team

The choice between them depends on the unique needs and preferences of businesses and nonprofits. Traditional firms may offer a personal touch and established local presence, while virtual CPA firms provide flexibility, expanded reach, and the benefits of advanced technology. Ultimately, organizations should carefully assess their requirements and consider the advantages offered by each approach to make an informed decision.

“When you wake up, center yourself, do deep breathing, and think about what your priorities for the day are going to be,” Bhargava advised. If you still want to check email first thing during your morning cup of coffee, then cap it to an hour. It’s also important for organizations to set up policies that govern in-home technology setups. “Then move on to education and safe usage practices with every employee,” he said. When the pandemic started, he watched YouTube qualitative characteristics definition and meaning videos about lighting and setting up a professional home studio and soon after upped his video quality, which helped his business tremendously. Eight years later, LiveCA is thriving, employing about 80 people, and handling both Canadian and American clients.

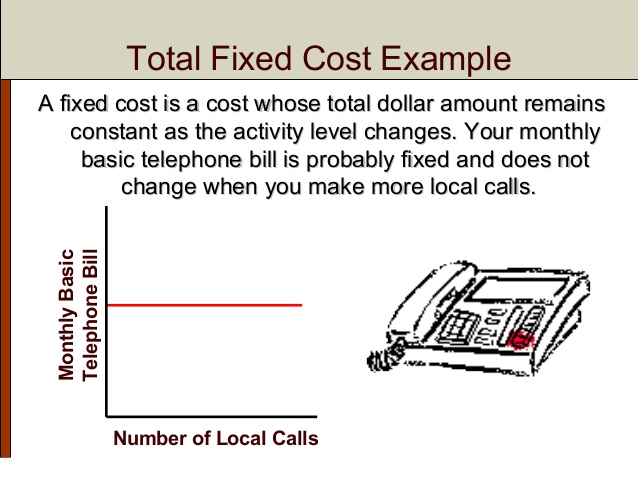

Reduced Costs

If you were hoping for a one-stop shop that can tackle all of your financial needs, Merritt might not be the right choice for you. The accounting service that you will choose will handle sensitive financial information about your business which is always at a risk of a data breach. You do not want to land into legal issues because of mistakes in your books or missing vital information while filing your taxes. To make sure this does not happen, you must choose an accounting service that has been around for a while and has a proven legacy. Some of these services include forecasting and planning, management reporting, board presentations, financial analysis, strategic analysis, and others. When you sign up for their services, you get a dedicated bookkeeper, manager, and CPA who help you with your bookkeeping, payroll, and taxes.

( Step 1 ) Know Your Company’s Financial Insights Anytime, Anywhere!

All your business’ financial information will be presented to you in easy-to-understand reports use these fundraising email templates to reach your goal and your dedicated inDinero accountants will help you interpret the data. When comparing traditional accounting firms with virtual CPA firms, it is important to consider the distinguishing factors that shape each approach. Running a successful nonprofit or small business requires a great deal of time, effort, and resources.